Five AI Systems That Raise Your Business Valuation

Document, automate, and position your business for premium multiples in 90 days

Hey Adopter,

Buyers don’t pay for revenue. They pay for predictability.

Roy Redd has bought six businesses. He’s walked away from dozens more. The pattern is always the same: great revenue, terrible systems. Everything lives in the founder’s head. Customer relationships belong to one person. Financial records are a mess. No documentation exists. This article was his idea, and I thought it would be valuable to you, whether you are selling your business or not.

Valuation research shows this owner-dependency creates a 10-25% discount. Most founders never recover from it.

AI removes that discount in 90 days.

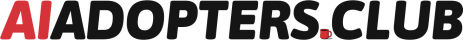

What you’ll learn in this newsletter:

The five specific AI systems that increase your valuation multiple by 1-1.5x (moving typical 3x businesses to 4-4.5x multiples). Each system removes a specific risk buyers discount for: undocumented processes, messy financials, unpredictable support, key-person hiring dependency, and weak positioning.

You’ll see the exact tools to deploy (Scribe, Datarails, Intercom AI, Ashby, Gamma), the valuation impact of each system (+0.3x to +0.7x per upgrade), and the implementation timeline (60-90 days from start to buyer-ready).

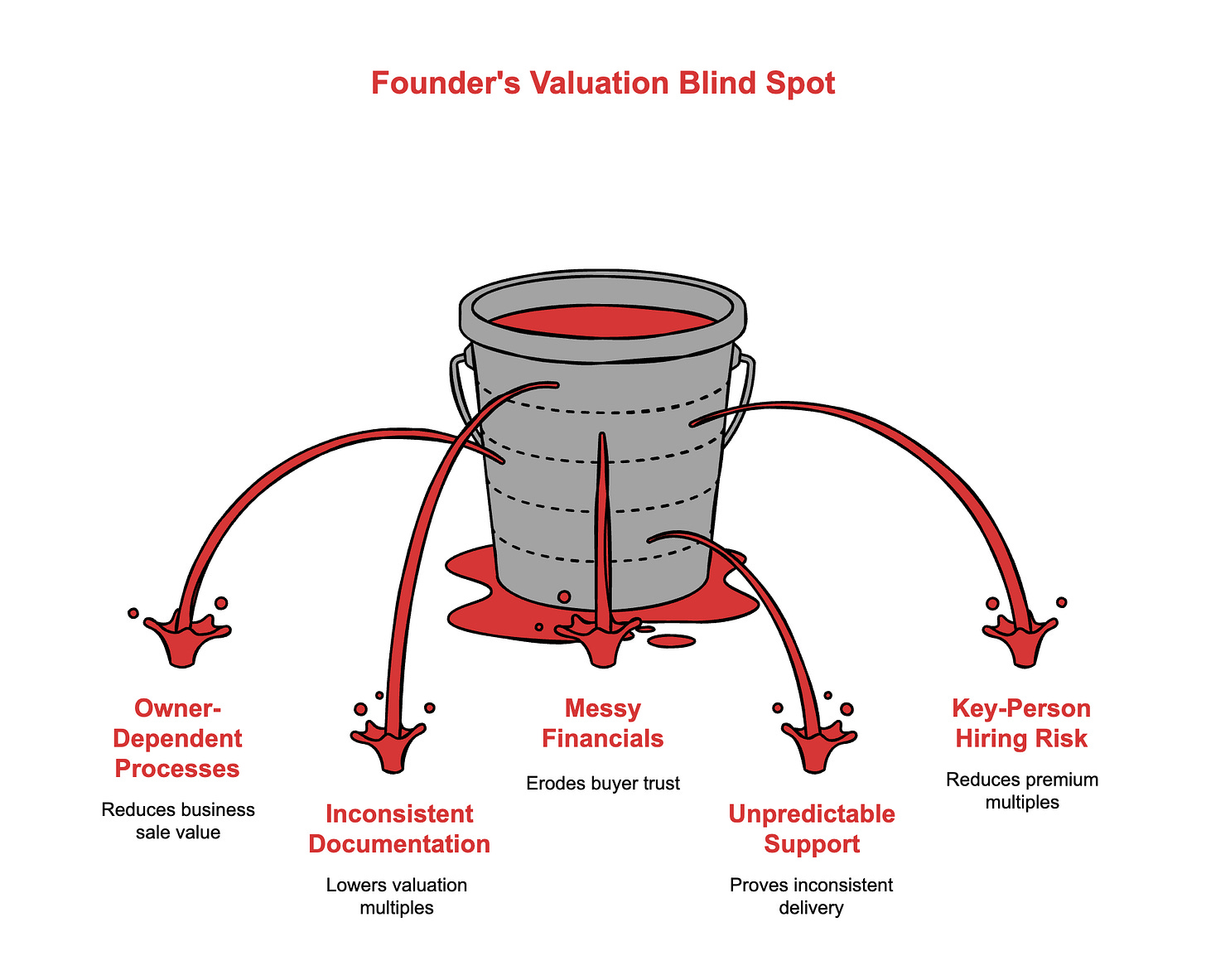

The example: McCarron Home Care’s October 2024 balance sheet. $18,970 in assets, zero documentation. We’ll show you how AI turned that into investor-ready financials, pitch decks, and operational documentation in minutes.

The math: $500K EBITDA at 3x = $1.5M. Same business at 4.5x = $2.25M. That’s $750K in additional value from systematic risk reduction, not revenue growth.

This isn’t about growth hacking. It’s about proving to buyers that your business runs without you.

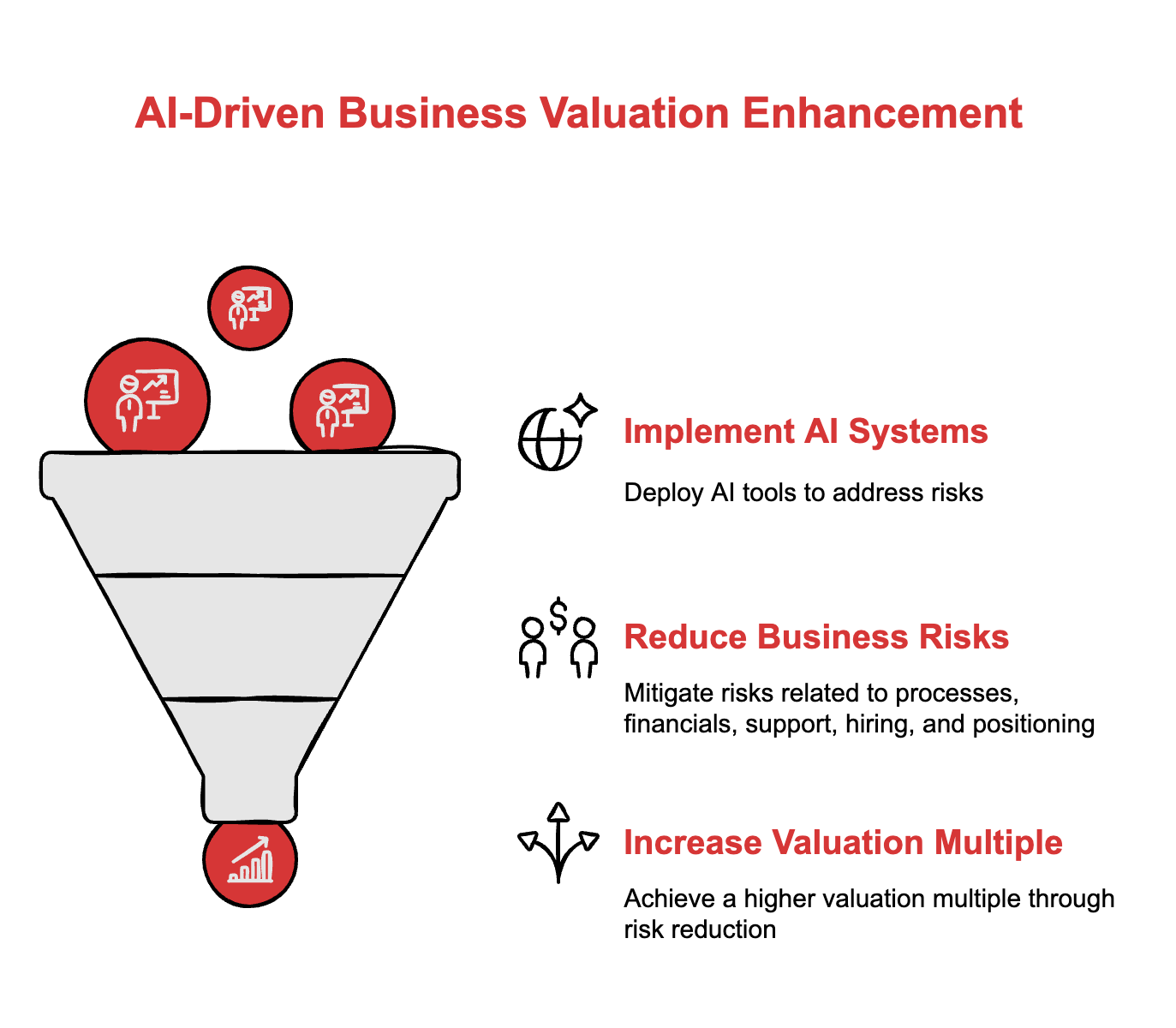

The valuation problem most founders miss

Buyers discount what they can’t predict.

Owner-dependent processes, inconsistent documentation, messy financials, unpredictable support quality, and key-person hiring risk all reduce what someone will pay for your business. These aren’t product problems. They’re system problems.

BizBuySell tracks business sale data showing businesses with documented processes consistently sell for 0.5-1x higher multiples than comparable companies without documentation.

AI fixes system problems at scale. Which brings us to the five upgrades.

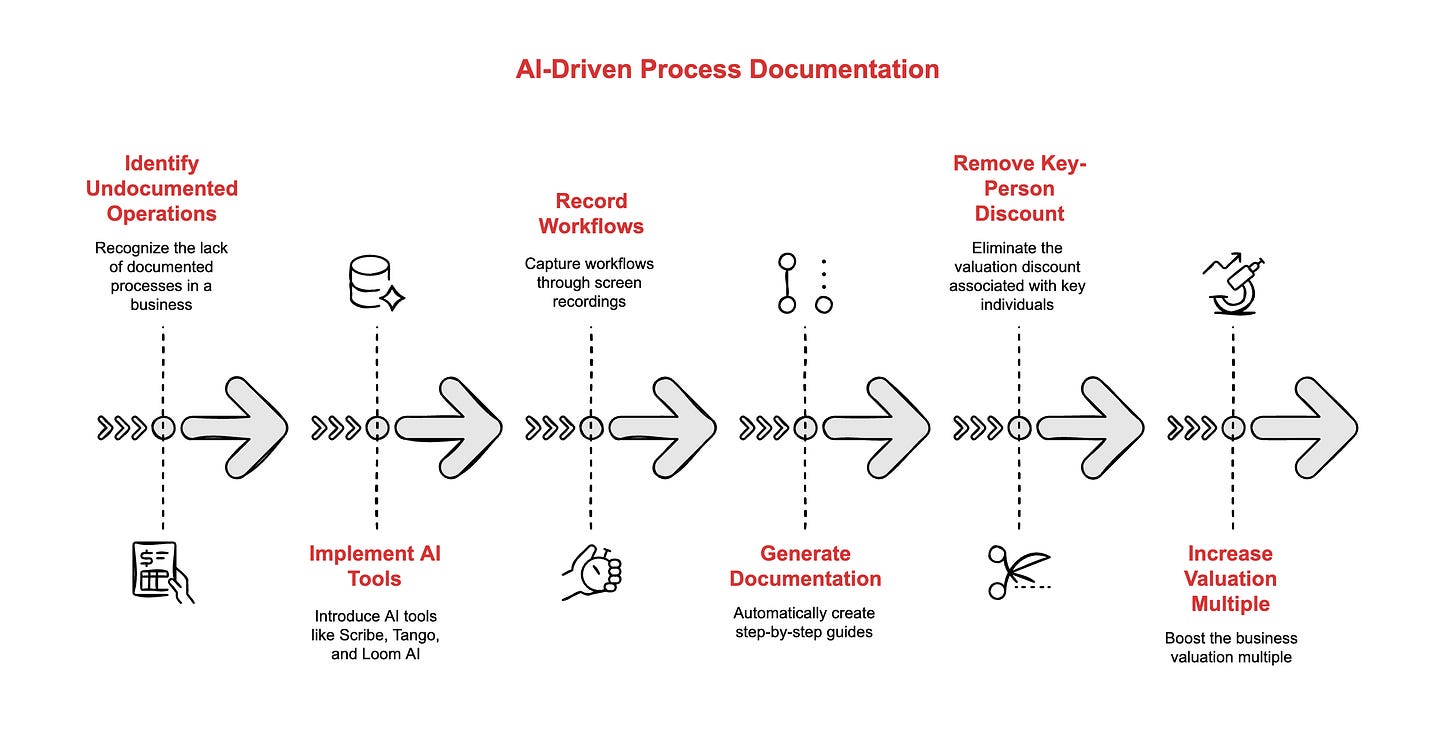

System 1: Process documentation that removes owner-dependency

Zero A/R. Thin equity. Cash-only operations.

That’s what most service businesses look like. McCarron Home Care’s October 2024 balance sheet showed $18,970 in assets, $16,193 in liabilities, and $2,777 in equity. The business ran entirely on cash flow with no documentation.

AI tools turn undocumented operations into documented systems in hours, not months.

Scribe, Tango, and Loom AI auto-generate step-by-step guides from screen recordings. Record a workflow once, get annotated documentation automatically. No technical writing required.

What this fixes: Key-person discount. When buyers see documented processes for workflows, onboarding, customer fulfillment, sales processes, and internal checklists, they stop asking “what happens when you leave?” They start asking “when can we close?”

Impact: Removes the 10-25% key-person discount that business valuation research shows in businesses dependent on specific individuals.

Valuation lift: +0.3x to +0.7x multiple

Implementation: 2-3 weeks

This solves the documentation problem but creates another one.

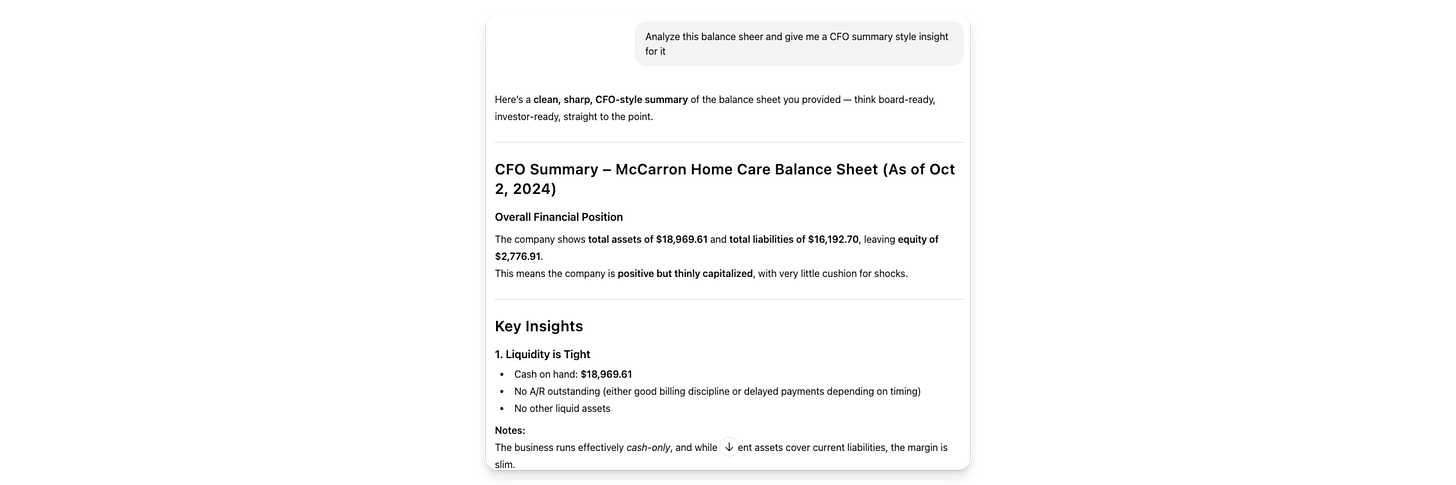

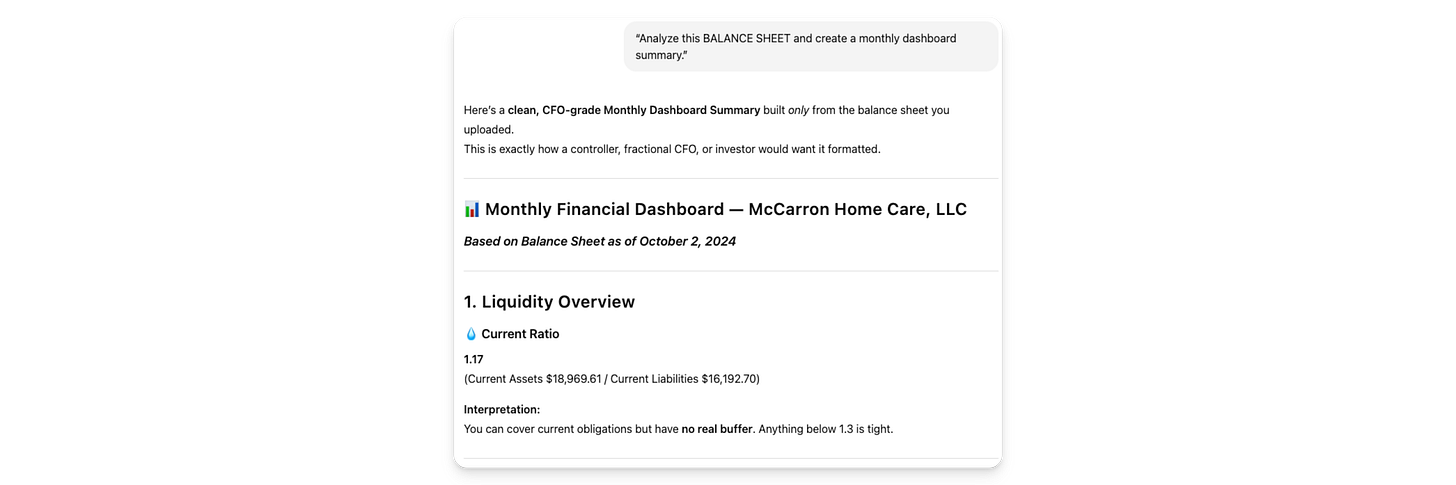

System 2: Financial cleanup that builds buyer trust

Buyers ask three questions about your numbers: Are they real? Are they clean? Can I trust them?

Messy financials kill deals. Business broker surveys consistently rank “unclear financial records” as the number one reason transactions fail during due diligence.

AI bookkeeping tools convert chaos into investor-ready dashboards. Pilot, Digits, Datarails, and QuickBooks AI take 20-hour CFO tasks and finish them in 20 minutes.

The McCarron balance sheet example shows this transformation. Raw QuickBooks export becomes a board-ready CFO summary. Same data, formatted the way investors expect to see it.

McKinsey’s research on generative AI found these tools reduce close time by 40-60% while improving accuracy. Clean books shorten due diligence from weeks to days.

Impact: Faster trust, lower perceived risk, premium pricing.

Valuation lift: +0.3x to +0.5x multiple

Implementation: 1-2 weeks

Clean numbers create trust, but predictable delivery creates confidence.

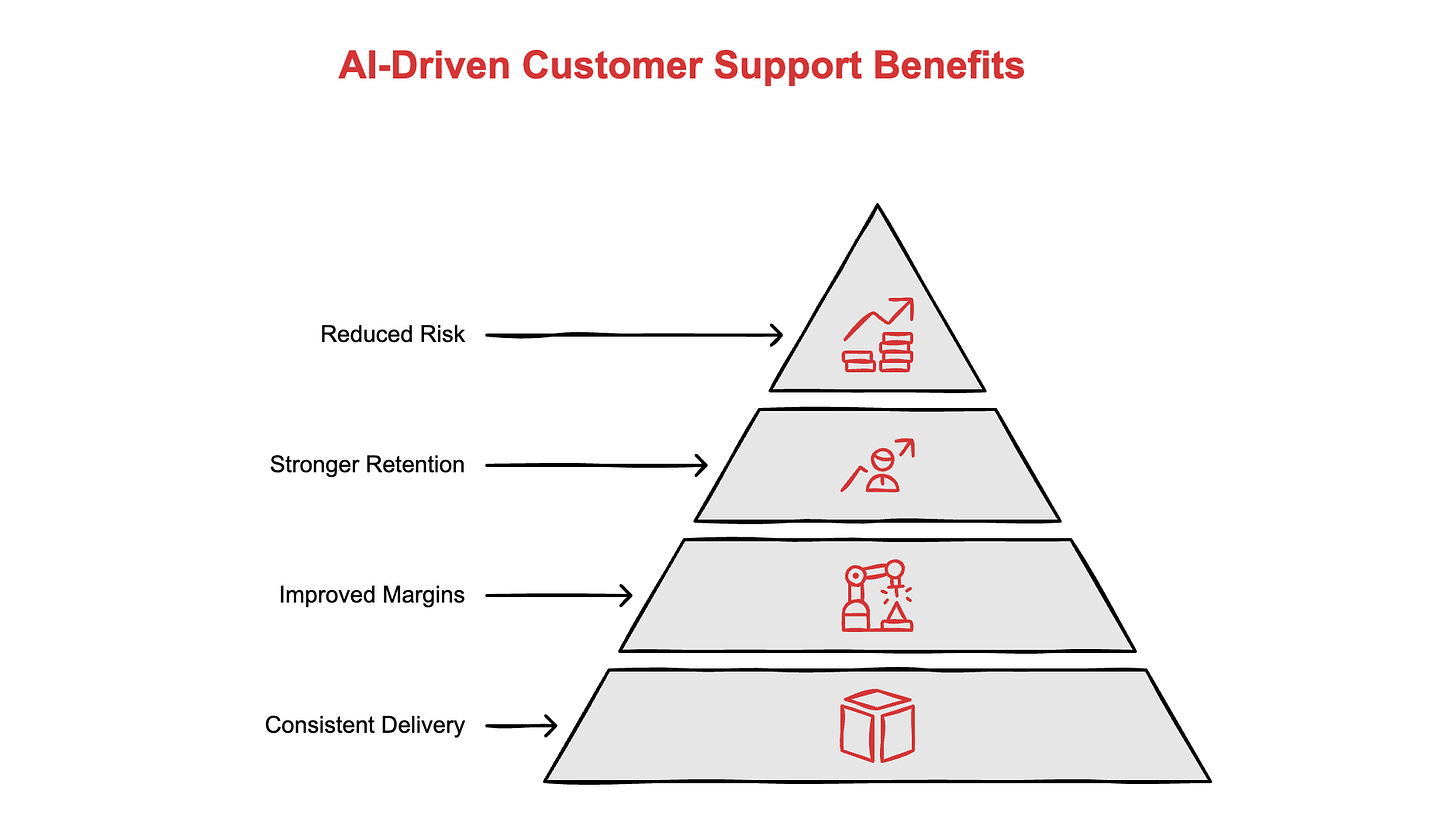

System 3: Customer support that proves consistent delivery

Buyers pay for predictable margins.

Unpredictable support costs, inconsistent response times, and manual ticket routing all signal risk. AI support systems remove the volatility.

Intercom AI, Forethought, Zendesk AI, and Help Scout handle FAQs, troubleshooting, scheduling, order updates, and ticket routing automatically. They learn from past conversations and improve over time.

When support becomes automated, three things happen: margins improve, retention strengthens, and volatility disappears. Buyers see consistent delivery that doesn’t depend on hiring or training new support staff.

Impact: Stronger margins, better retention, reduced operational risk.

Valuation lift: +0.3x to +0.5x multiple

Implementation: 3-4 weeks

Good support keeps customers. Good hiring systems keep the business running.

System 4: Hiring and training systems that reduce key-person risk

“What happens if your key people leave?” is the question that destroys valuations.

AI hiring tools eliminate the answer that kills deals: “I’d have to replace them myself.”

Ashby, HireVue, Paradox, and Zavvy handle job posting, resume screening, first-round interviews, skill assessments, training programs, and role-play simulations.

SHRM’s research on AI in the workplace shows AI recruiting tools reduce time-to-hire by 35-50% while improving candidate quality. More valuable: they remove founder dependency from the hiring process.

When buyers see automated hiring and training systems, they stop worrying about talent risk. The business scales without you.

Impact: Removes founder dependency from talent acquisition and development.

Valuation lift: +0.3x to +0.6x multiple

Implementation: 2-3 weeks

Systems create scalability. Positioning creates the premium multiple.

System 5: Strategic positioning that commands premium multiples

Great businesses get mediocre valuations when their positioning is unclear.

AI strategic tools create the market maps, competitive analyses, customer segmentation, pricing optimizations, and investor-ready presentations that make your business look like a scalable asset instead of a small operation.

Gamma, Tome, and Claude generate positioning materials in hours. CB Insights shows how these tools are used for market analysis and competitive positioning.

The McCarron example demonstrates this. One month of balance sheet data becomes a complete pitch deck with executive summary, financial projections, market positioning, and growth thesis. Structured exactly how M&A bankers and private equity funds expect.

Buyers pay more for businesses that present well, not just businesses that perform well.

Impact: Improves buyer perception, clarifies positioning, frames growth potential.

Valuation lift: +0.2x to +0.4x multiple

Implementation: 1-2 weeks

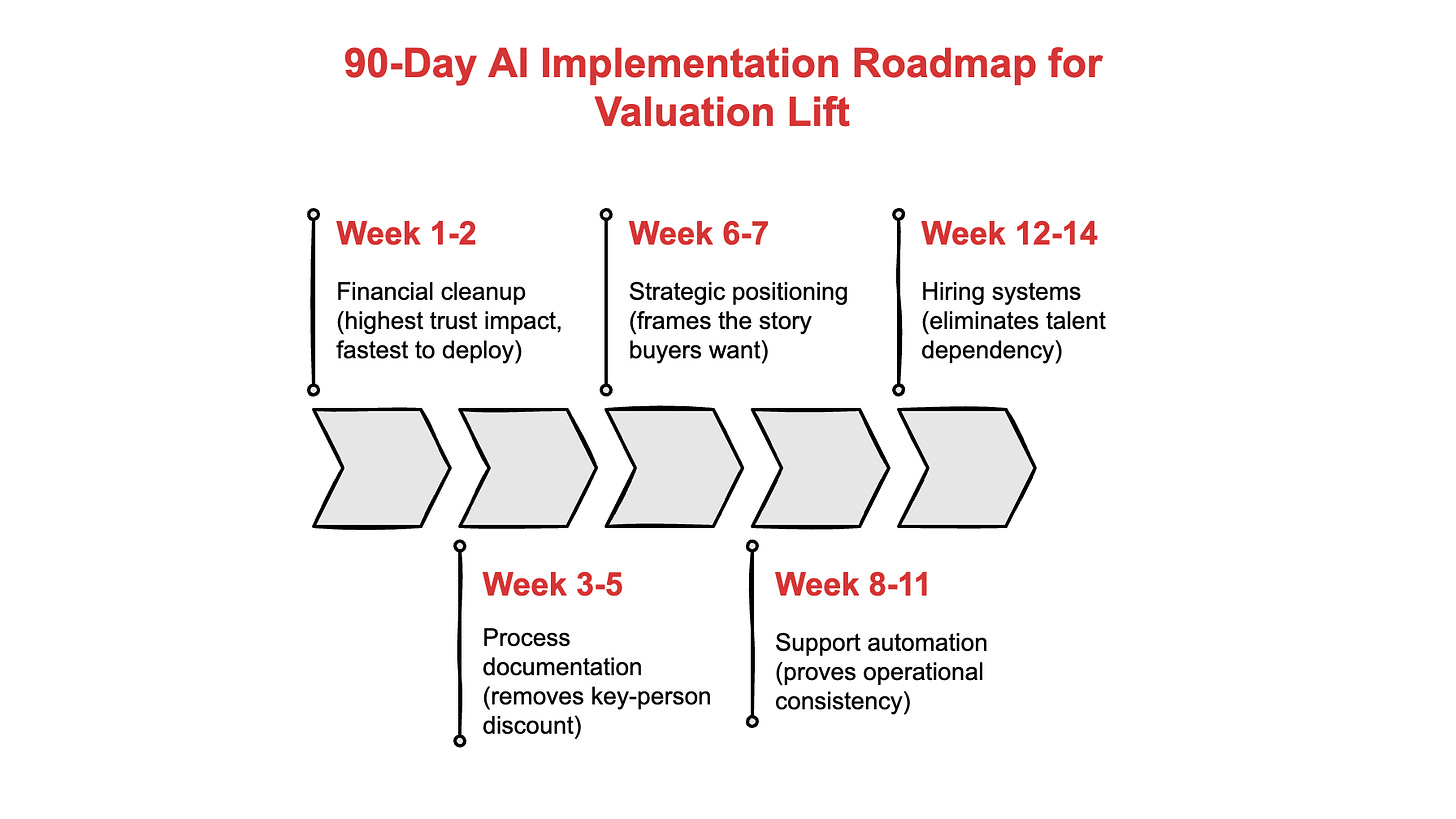

The implementation roadmap

Five systems. 90 days total. Cumulative valuation lift: +1.0x to +1.5x multiple for most businesses in the $1-5M revenue range.

The math matters. A $500K EBITDA business at a 3x multiple sells for $1.5M. That same business at a 4.5x multiple sells for $2.25M. The $750K difference came from systematic risk reduction, not revenue growth.

Research on AI implementation found businesses that deploy documentation, financial, and operational AI systems see measurable valuation improvements within 90 days of deployment. The U.S. Chamber’s AI guide for small business provides implementation frameworks specifically for businesses under $10M revenue.

The opportunity is simple: AI removes the risks that reduce valuations. Document your processes so buyers trust operational continuity. Clean your financials so due diligence moves faster. Automate support so margins stay consistent. Systematize hiring so talent risk disappears. Position strategically so buyers see scale potential.

You don’t need technical skills or a large team. You need systems that make your business predictable.

Deploy these five upgrades and you stop being a “risky, owner-dependent operation” in buyer eyes. You become a documented, scalable asset worth a premium multiple.

Note: Roy Redd is a 6-time bestselling author, M&A strategist, and creator of Buy Build Exit, where he helps founders prepare businesses for high-value exits using AI, documentation, and strategic positioning.

This is a clear playbook. AI isn’t just about efficiency, it directly drives valuation by removing operational and founder risks that buyers discount heavily.

Love this - a great opportunity to speak with business brokers who are dealing with owners whose business are just not viable to sell yet and help them get things in order.