Your Excel Skills Just Became Worthless Overnight

How 25 million professionals lost their competitive edge last week

Hey Adopter,

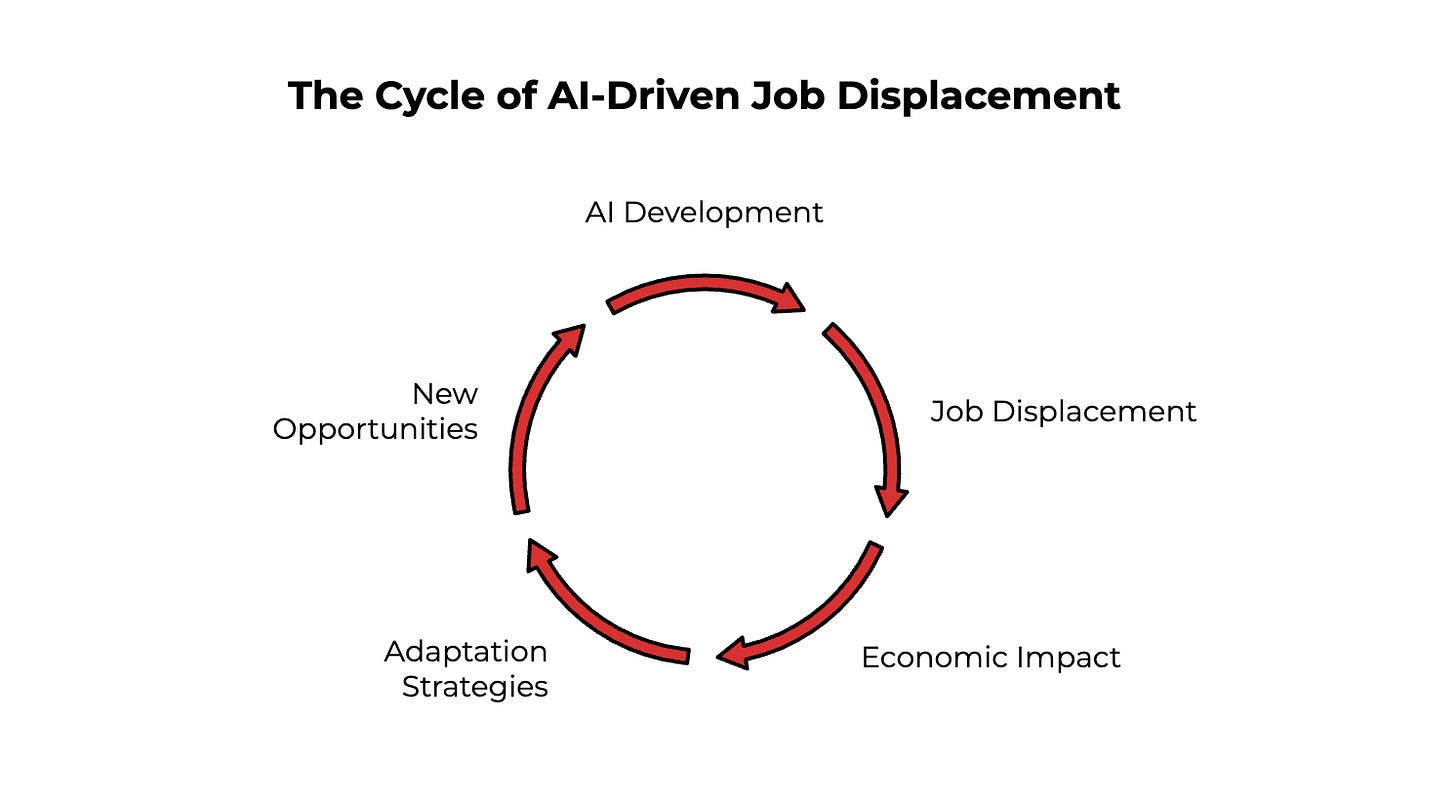

OpenAI dropped a bomb a few weeks ago. Not the flashy kind that gets tech reporters excited. The kind that makes 25 million Excel operators wake up in cold sweats.

Their new ChatGPT agent doesn't just help with spreadsheets. It replaces the humans who live in them. 3.9 million finance professionals, 3.2 million accountants, and 4.6 million administrative workers suddenly find their core skills automated. Financial analysts building models for hours? Done in minutes. Accountants linking complex cash flow statements? Automated. Investment professionals running scenario analyses? The machine handles it.

We're talking about $1.8 trillion in wages suddenly looking vulnerable. With professionals earning Microsoft Excel skills averaging $69,000 annually and financial analysts earning a median of $101,910, that wage pool represents real economic disruption. That's not a rounding error. That's the entire economy of Canada sitting in AI's crosshairs.

Here's what you need to know about surviving the Excel apocalypse, and more importantly, how to position yourself in the director's chair while others scramble for the exits.

The death of Excel monkeys

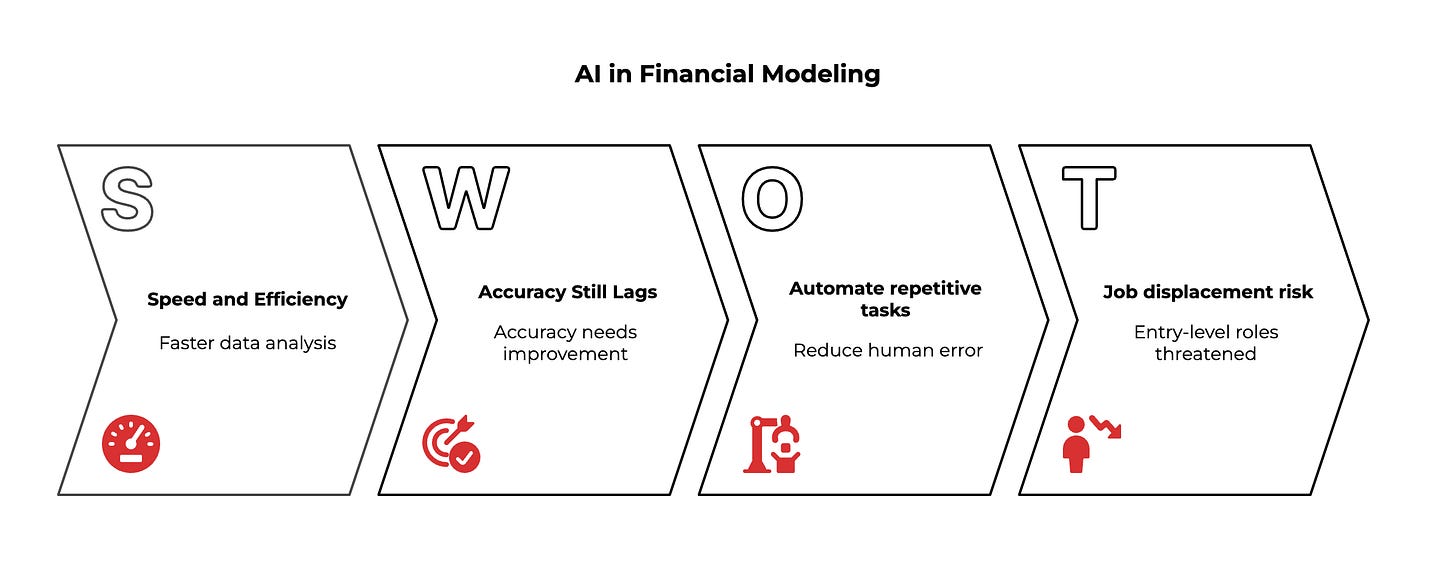

The numbers tell a brutal story. ChatGPT's agent achieves 45.5% accuracy on real-world spreadsheet tasks, more than double Microsoft Copilot's 20% performance. Sounds like humans still have an edge, right? Wrong.

That 45% captures today's performance. The gap closes fast. More concerning, the 45% covers the standardized, high-volume work that employs millions. Building income statements. Linking balance sheets. Running cash flow projections. The bread-and-butter tasks that junior analysts spend years mastering.

The agent builds complex financial models in minutes, not days. It pulls data, applies assumptions, creates linkages across sheets. Everything a first-year analyst does, except faster and without coffee breaks.

Entry-level roles die first. Two-thirds of entry-level finance jobs face elimination due to AI automation. Major Wall Street firms are considering cutting junior analyst hiring by as much as two-thirds as they rely more heavily on AI. These jobs won't disappear gradually. They'll vanish. One day they're essential, the next day they're redundant.

Your six-month survival window

Here's the only good news in this story. Enterprise adoption lags behind capability. Companies won't hand over sensitive financial data to external AI agents until privacy and security concerns get resolved. Best estimates put that timeline at 6-12 months.

Six months to reinvent yourself. Not six years. Not even sixty weeks.

Most professionals will waste this window. They'll spend it complaining about AI hype, hoping their company moves slowly, or pretending their Excel expertise makes them irreplaceable. Meanwhile, smart operators are already climbing into the director's chair.

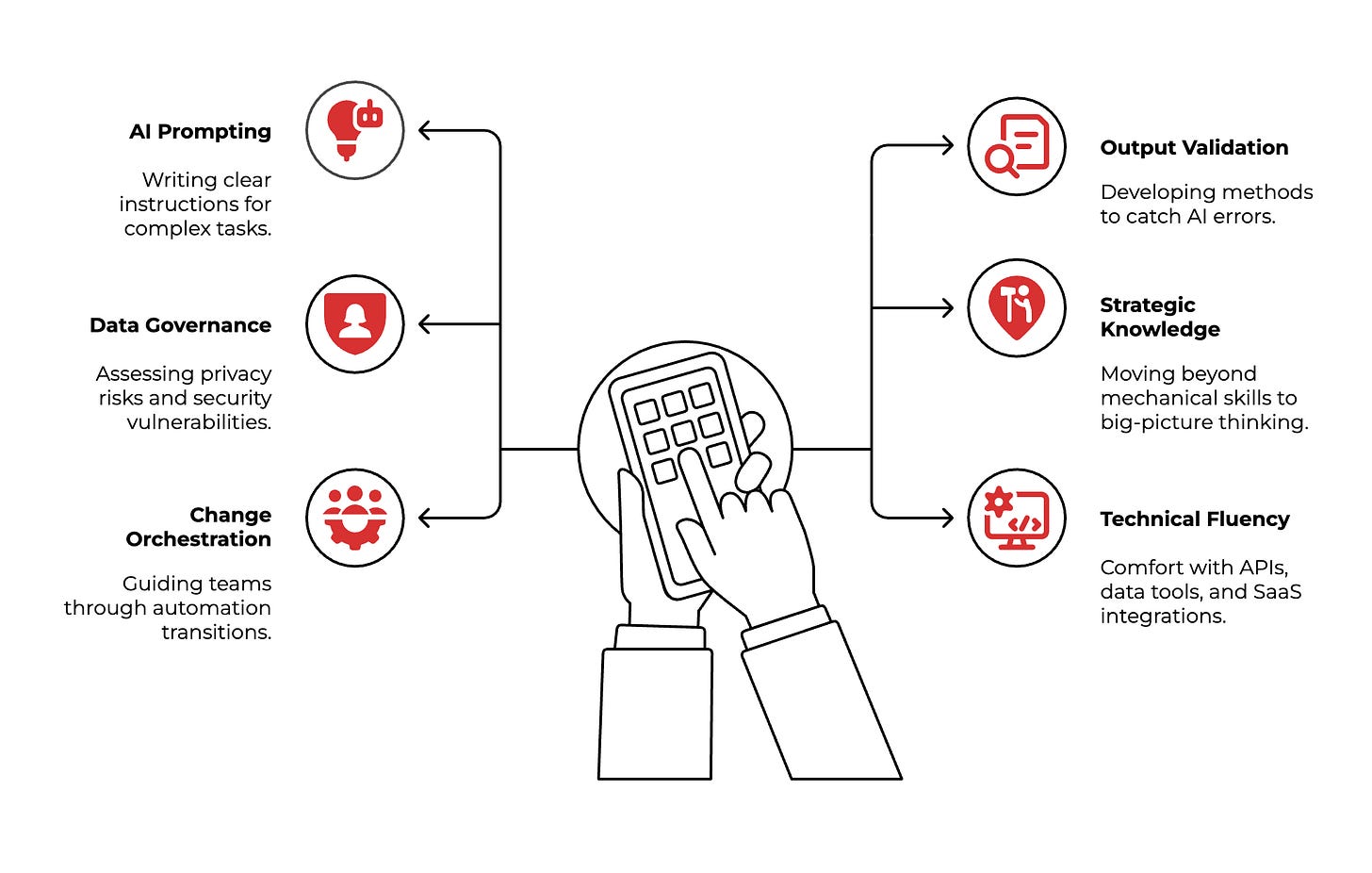

The director's chair skillset

The survivors aren't learning to code. They're learning to conduct. Instead of doing the work, they're orchestrating AI that does the work better, faster, and cheaper.

Here's what separates directors from casualties:

AI prompting mastery

Writing clear instructions for complex, multi-step tasks. Breaking down business requirements into workflows that AI agents can execute. Understanding where AI breaks down and structuring tasks to avoid those pitfalls. AI-assisted analysis runs 56% faster than human-only approaches, but only when properly directed.

Output validation systems

Developing methods to catch AI errors that look convincing but contain fatal flaws. Using secondary AI agents to double-check primary outputs. Building diagnostic frameworks that spot logical inconsistencies before they reach clients.

Data governance expertise

Assessing privacy risks, security vulnerabilities, and regulatory implications of AI-powered workflows. Creating audit trails for AI-generated work. Managing data integrity across automated processes.

Strategic domain knowledge

Moving beyond mechanical skills to big-picture thinking. Asking the right business questions. Identifying opportunities that AI automation creates rather than just replacing old tasks with new tools.

Change orchestration

Guiding teams through automation transitions. Managing resistance. Translating AI capabilities and limitations to stakeholders who don't understand the technology but need to make decisions about it.

Technical fluency without technical depth

Comfort with APIs, data tools, and SaaS integrations. Configuration thinking instead of manual execution. Setting up and monitoring automated systems rather than running them by hand.

The mindset flip

The hardest part isn't learning new skills. It's abandoning the identity that made you successful.

Excel experts built careers on precision, attention to detail, and manual mastery. The director's chair requires curation, strategic oversight, and comfort with managed imperfection.

From producing work to reviewing work. From routine execution to strategic deployment. From knowing how to do everything to knowing how to evaluate everything.

This shift feels foreign. It should. The professionals who adapt fastest will be those who embrace feeling incompetent again. Learning beats knowing in a world where capabilities change monthly.

The competitive advantage hiding in plain sight

While 25 million Excel operators panic about automation, smart professionals see the opening. Every automated role creates demand for someone to manage the automation.

Companies still need financial models. They still need data analysis. They still need strategic thinking about numbers. They just don't need humans to move the numbers around spreadsheets anymore.

The directors who master AI orchestration will manage the work of ten analysts while those analysts job-hunt. The consultants who build AI-powered service lines will win clients from competitors still billing hourly for manual Excel work.

This isn't about replacement. It's about multiplication. The professionals who figure out how to multiply their impact through AI direction will own the next decade.

Your Excel skills aren't worthless because they're automated. They're worthless because everyone else has them too. The differentiation comes from what you do with AI that others can't.

Six months. Use them wisely.

Adapt & Create,

Kamil

We’ve created a lot of useless busy work. Making errors, fixing errors, spending so much time building reports rather than adding value. This could cure that for experienced accountants and free them up to add more value. We will need new ways in the near future to train junior staff so they have a solid understanding without needing to ever do this grunt work.

When Excel introduced advanced finance functions (however many decades ago) - it was great because suddenly people didn’t have to manually build out big ugly present value formulas or amortization schedules…it was a time saver but didn’t immediately put all financial analysts out of work. Like any tool or library, it made certain aspects of their job easier…so is this a real game changer? Or is it just another stepwise / natural evolution of a widely used tool?

Maybe my skepticism is because your premise feels like kind of a cartoony view of what people who work in and around spreadsheets *actually* spend time doing…

But far be it from me to bury my head in the sand… I’ll pull some of my most complex workbooks out of the archives and see how well an AI agent can replicate them (and report back!)