Why Your Business Sale Will Fail (And How AI Fixes It)

The hidden factor that kills 80% of deals and the AI solution that saves them

Hey Adopter,

Your business might be worth 25 percent less than you think. Not because your revenue's weak or your margins are thin. Because buyers see you as the single point of failure.

Valuers call it key person risk. In practice, it shows up as a haircut on your multiple.

In this article, you'll learn how to:

Map the five jobs your CEO brain performs to specific AI-assisted workflows your team can run

Prove operational independence with a 30-day plan and a 7-day absence test

Turn a key-person discount into a cleaner, faster sale with a stronger multiple

The valuation trap

When my friend Eric Landis evaluates businesses for sale, he sees the same pattern. Smart founders who built successful companies, then made themselves irreplaceable.

Their reward? A valuation haircut that can cost them hundreds of thousands, sometimes millions.

Professional valuers apply discounts of 10 to 25 percent to companies that can't function without their founder. Shannon Pratt, the most respected name in private company valuation, established this range. It's now industry standard.

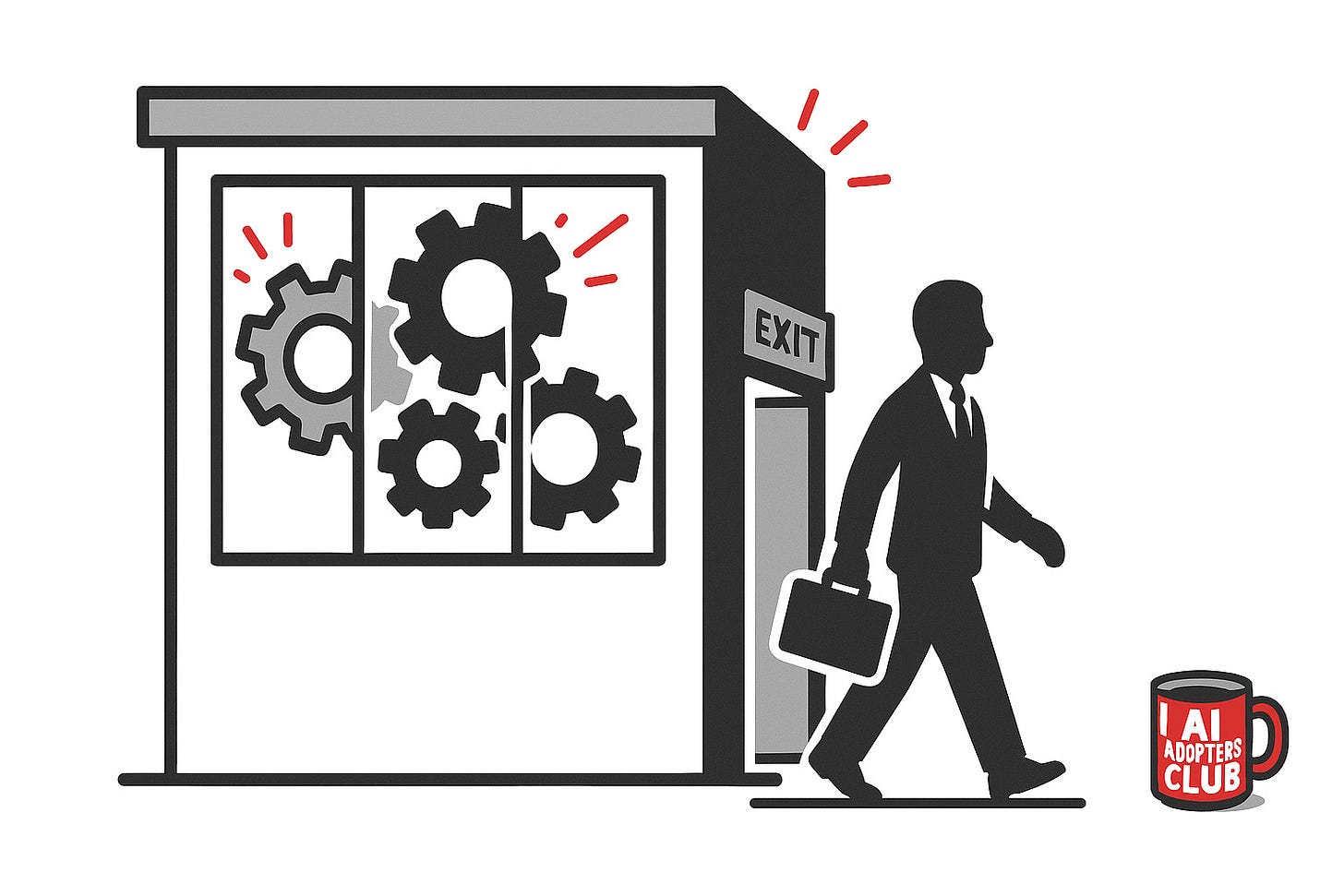

Owner dependency doesn't just reduce your multiple. It sabotages the entire M&A process:

Reduced marketability. A business that can't run without its owner is inherently less marketable. The pool of potential buyers shrinks because each acquirer has different tolerance for transition risk.

Prolonged due diligence. Educated buyers will analyse how relationships and intellectual capital might transfer post-acquisition. If critical processes exist only in your head, buyers struggle to evaluate sustainable earnings potential.

Unfavourable deal structures. Even willing buyers will shift risk back to you. Instead of clean, all-cash-at-closing deals, expect earn-outs contingent on post-sale performance. Seller financing requirements. Extended handover periods that tie your final payout to new owner success.

The stark reality: small business sale success rates hover around 20 percent. Owner dependence is a leading cause of failure.

Risk diagnostic framework

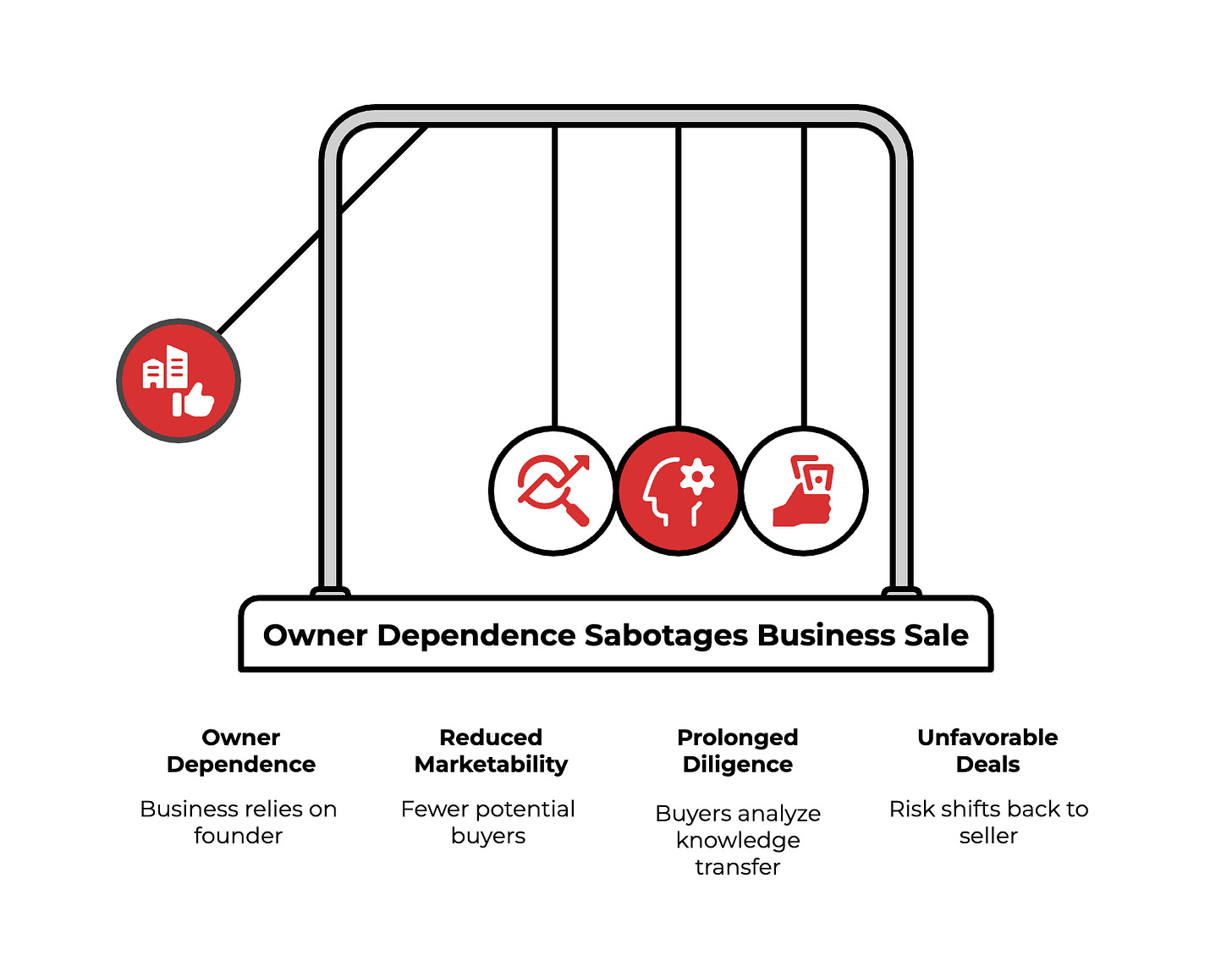

Before building solutions, diagnose the severity across critical business functions:

Customer relationships (5-8% valuation discount risk) High risk: Single customers exceeding 10 percent of revenue, managed exclusively by owner. Low risk: Diversified customer base with relationships managed through CRM systems.

Operational knowledge (4-7% discount risk)

High risk: Critical processes undocumented, residing in owner's head. Low risk: All core functions have documented SOPs stored in accessible knowledge bases.

Strategic planning (3-5% discount risk) High risk: Owner is sole source of strategic planning and innovation. Low risk: Documented business plan with management team actively contributing to strategy.

Brand reputation (2-4% discount risk) High risk: Company brand synonymous with owner's personal brand. Low risk: Strong, independent brand identity distinct from owner's personal reputation.

Team culture (2-4% discount risk) High risk: Employee loyalty dependent on owner's personal leadership style. Low risk: Strong, independent leadership team with defined decision-making authority.

These percentages compound. A high-risk state across all categories can justify the full 25 percent key person discount.

Think about it: buyers aren't just discounting the loss of you. They're pricing in the substantial cost, time, and risk of building the systems you never created.

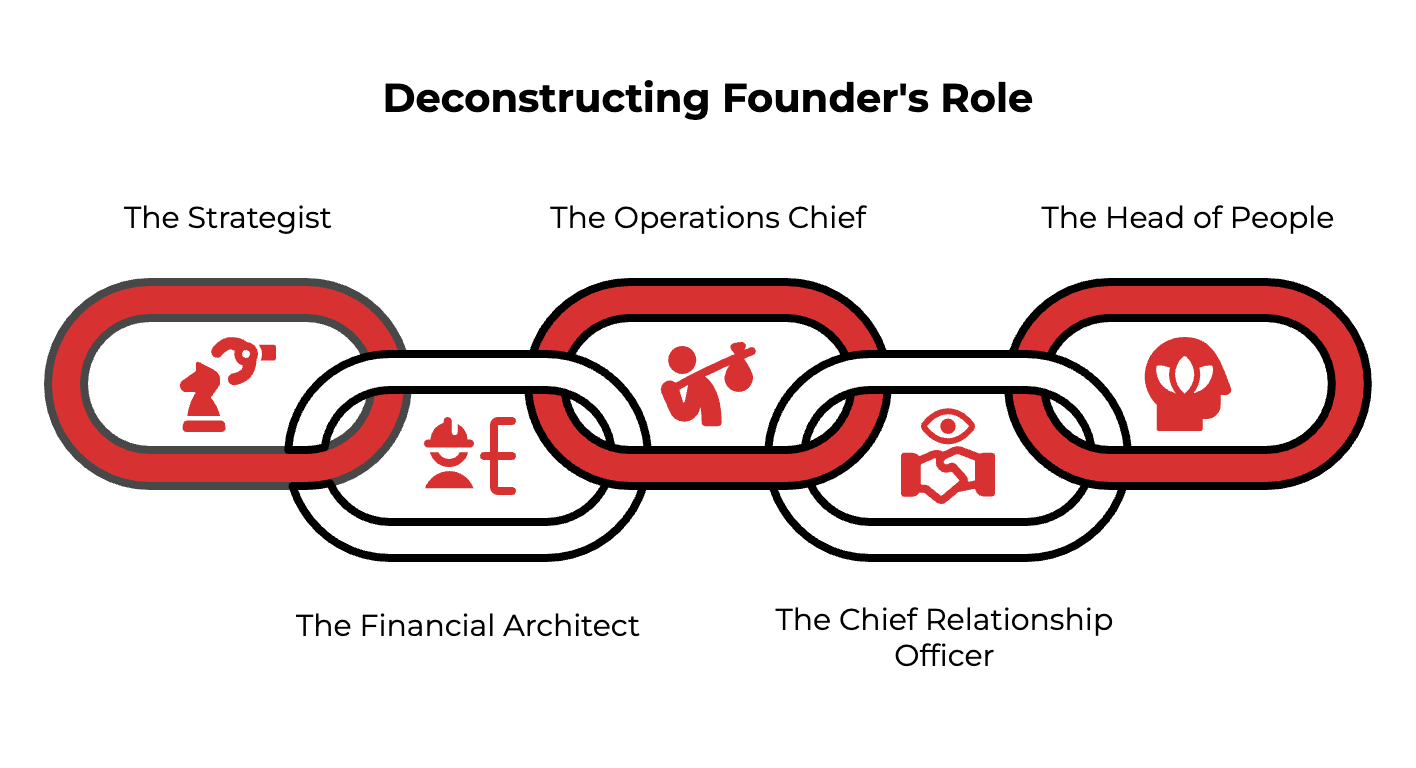

Five jobs, not one

The perception of founder indispensability dissolves under analysis. What appears as irreplaceable intuition is rapid data processing across distinct functional domains.

The Strategist synthesises internal and external data to formulate strategic plans. Continuous market research, competitive analysis, and scenario planning.

The Financial Architect makes major capital allocation decisions directing resources toward strategic goals. Oversees budget creation and performance monitoring.

The Operations Chief ensures seamless daily operations through effective resource allocation. Process optimisation and cross-departmental collaboration.

The Chief Relationship Officer serves as primary public face maintaining communication with stakeholders. Investors, partners, and key customers.

The Head of People builds leadership teams, attracts top talent, and shapes corporate culture. Aligned with company mission.

The deconstruction process itself creates value. To automate a function, it must be understood, defined, and documented. This mandatory operational housekeeping addresses root causes of owner dependency.

AI tools that work today

Modern AI platforms can assume analytical and operational duties whilst preserving uniquely human leadership elements.

Strategy: market intelligence

AI transforms strategy development by acting as tireless researchers and rigorous simulators.

AI tools continuously monitor news outlets, social media, and industry publications to track competitor activity. Market trends get spotted faster. Platforms like Competely.ai automate the entire competitive intelligence workflow, saving hundreds of research hours whilst providing real-time competitive landscape views.

AI-driven forecasting models dramatically outperform traditional methods. They analyse wider data ranges: historical sales, macroeconomic indicators, social media sentiment. Platforms run complex simulations projecting profit and loss statements under various strategic scenarios.

Finance: FP&A and expenses

AI-driven FP&A platforms analyse historical financial data to generate accurate budget forecasts and cash flow predictions. Key capabilities include sophisticated what-if scenario modelling.

Platforms like Cube, Datarails, and Planful integrate directly with ERP and CRM systems. Single sources of financial truth with conversational AI interfaces.

The entire expense management process can be automated. Tools like Expensify, Fyle, and Brex use Optical Character Recognition to scan receipts. Machine learning categorises expenses automatically. Algorithms flag potential fraud in real-time.

Operations: supply chain and workflows

AI brings new intelligence to operations, transforming manual, reactive processes into automated, predictive systems.

Through accurate demand forecasting, AI systems optimise inventory levels. Often achieving 20-30 percent reductions that free significant working capital. These systems optimise warehouse layouts, plan efficient delivery routes, and predict equipment failures before they occur.

Robotic Process Automation utilises software bots to automate high-volume, repetitive digital tasks. Data entry, form completion, standard report generation. Without requiring changes to existing IT infrastructure.

Revenue: CRM and support

Modern CRM platforms like HubSpot and Salesforce are deeply integrated with AI. These systems use machine learning for predictive lead scoring, automatically identifying prospects most likely to convert.

AI analyses email communications for sentiment. Provides sales representatives with real-time call coaching.

AI-powered marketing platforms enable creation of highly personalised campaigns. Segment audiences with precision and automatically adapt marketing journeys in real-time.

AI agents provide 24/7 customer support. Understanding and resolving high percentages of routine inquiries without human intervention whilst intelligently routing complex issues to appropriate agents.

People: recruitment and development

AI revolutionises recruitment by automating time-consuming processes. AI-powered tools post jobs to multiple platforms, source passive candidates, and screen resumes to rank applicants based on job requirement matches. Whilst reducing unconscious bias.

AI platforms analyse employee performance data, skills assessments, and career aspirations. Create detailed skill profiles enabling talent gap analyses and personalised learning recommendations.

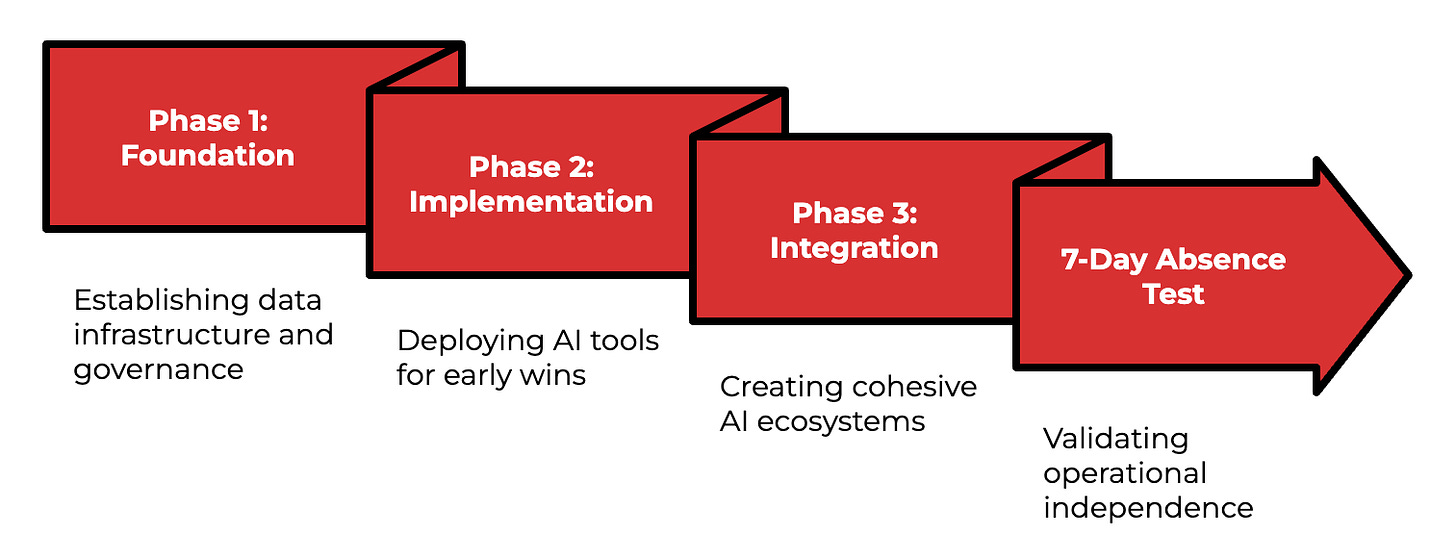

Three-phase roadmap

Phase 1: Foundation (months 1-6)

The objective is preparing organisations for AI by establishing necessary data infrastructure and operational clarity.

Key actions:

Conduct comprehensive data audits mapping entire organisational data landscapes

Establish formal data governance managing collection, storage, access, and security

Systematically document every core business process

Clean financial records, removing personal expenses and aligning records with external reporting standards

Phase 2: Implementation (months 7-18)

With solid foundations, organisations begin deploying AI tools for early, tangible wins targeting high-impact, repetitive tasks.

Key actions:

Prioritise manual, repetitive processes where AI provides immediate measurable impact

Redesign workflows fundamentally rather than layering technology onto existing processes

Deploy RPA bots for rules-based digital tasks in finance and administration

Augment strategic planning with AI-powered competitive intelligence tools

Phase 3: Integration (months 19-24+)

The final phase focuses on moving from point solutions to cohesive, integrated AI ecosystems proving businesses are sustainably owner-independent.

Key actions:

Integrate AI systems through platforms creating seamless data flows

Systematically delegate both responsibilities and decision-making authority to management teams

Validate independence through progressive reduction of office hours and operational involvement

Solidify independent leadership teams capable of managing current operations and future initiatives

The 7-Day Absence Test

You are out of office for seven days

Senior leaders make routine decisions using the operating playbook and dashboards

KPIs hold: revenue on plan, customer satisfaction steady, owner's hours in office per week at or near zero

Capture gaps, fix, repeat

Managing the transition

Effective AI implementation requires full CEO commitment. Can't be delegated solely to IT departments. Frame AI as co-pilot handling tedious tasks, freeing employees for creative, strategic work.

Invest in comprehensive training programmes upskilling existing workforces on new tools. Develop critical thinking and ethical oversight skills needed for effective AI collaboration.

If I were buying your company

I'd ask:

What breaks if the founder disappears for a week?

Your answer: show absence-test logs, decision rights, and KPI stability.

Are these automations brittle or human-overseen?

Your answer: specify where humans approve, what thresholds trigger review, and how changes are audited.

How this changes valuation

Discount to premium

The most immediate financial benefit is mitigation or complete elimination of 10-25 percent key person discounts. By creating businesses that demonstrably operate without owner daily involvement, primary justifications for discounts are removed.

Buyers pay higher multiples for businesses that can grow revenue without proportional cost increases. AI-driven businesses handle higher transaction volumes and manage more customers with minimal additional human resources.

Some analyses suggest businesses built around AI achieve valuation premiums three to five times higher than less technologically advanced competitors.

AI systems and clean, structured datasets become valuable intangible assets. Buyers acquire sophisticated data infrastructure and intelligence engines leverageable for future growth. Providing durable competitive edges recognised as higher valuation drivers.

Due diligence advantage

Due diligence phases are critical M&A transaction stages where many deals fail. Today's buyers increasingly use AI-powered tools conducting due diligence, rapidly scanning thousands of virtual data room documents.

Sellers who underwent AI transformation enter with decisive advantages. Having organised and structured data for their AI systems, they respond to buyer diligence requests almost instantly. Accelerating deal timelines whilst building buyer confidence and reducing risks of negative surprises.

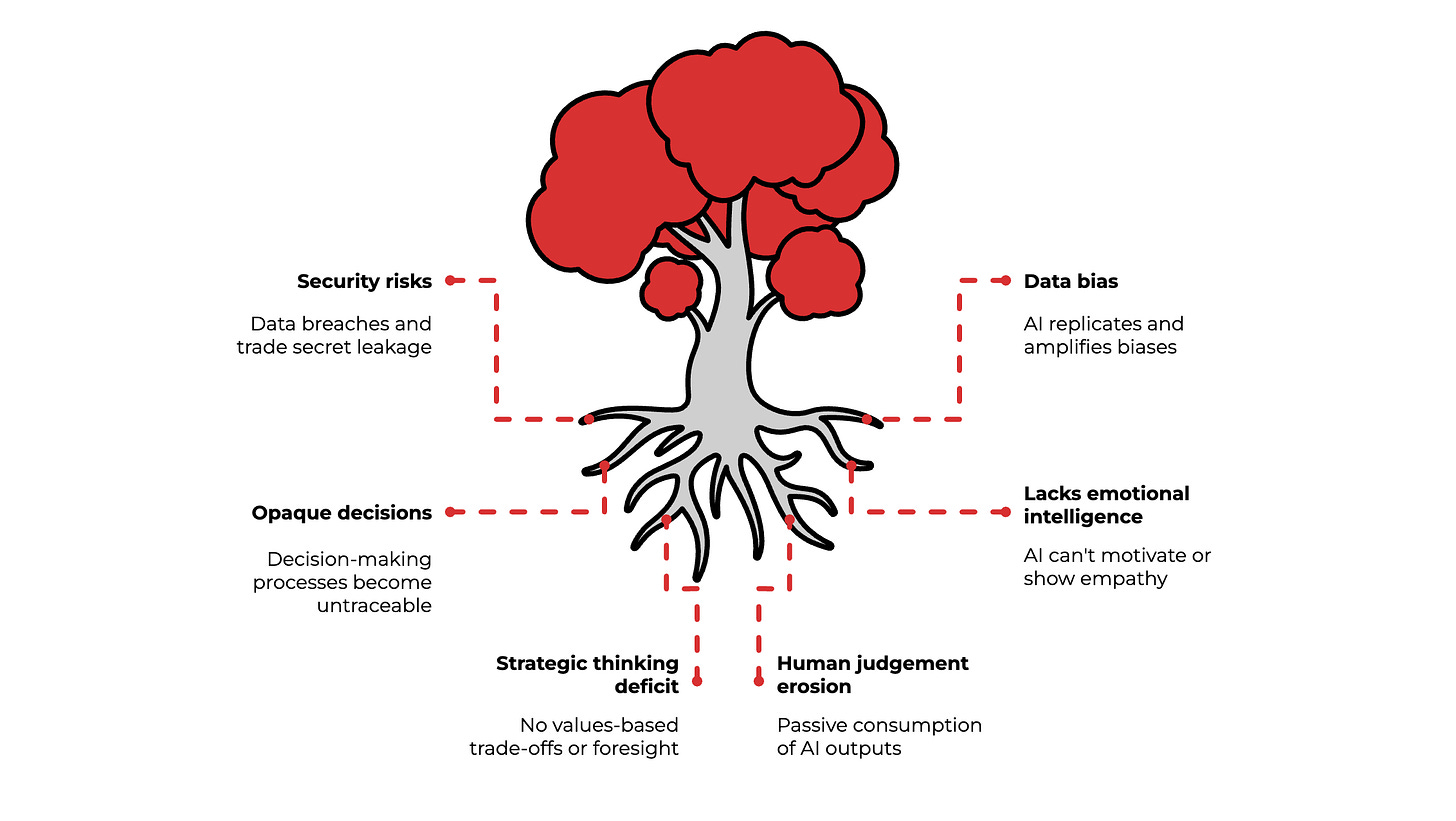

Risks and limits

Security and implementation

AI platform use introduces security risks, including potential data breaches and proprietary trade secret leakage. Comprehensive AI strategies must include rigorous security with data encryption, strict access controls, and thorough vendor vetting.

AI models learn from training data. If historical data contains biases, AI will replicate and amplify those biases at scale. Complex AI model black box nature can make decision-making processes opaque, posing accountability and transparency challenges.

Human elements

AI lacks genuine emotional intelligence, consciousness, and moral agency. Can't replicate leader abilities to motivate teams through crises, navigate complex interpersonal dynamics, or show genuine empathy. These uniquely human skills are often most critical drivers of long-term success.

AI operates based on historical data and predefined parameters. True strategic thinking involves making difficult, values-based trade-offs and possessing foresight beyond data-driven prediction.

Over-reliance on AI can lead to human judgement erosion. Passive consumption of AI outputs rather than active, critical interpretation.

Get the complete blueprint

Premium members get exclusive access to:

• The complete diagnostic framework - Detailed self-assessment tool with scoring rubrics to quantify exact key person risk across five critical business functions, plus specific remediation strategies for each risk factor

• The full AI toolkit directory - Exhaustive catalogue of 50+ SME-focused AI platforms, categorised by function, with pricing models, implementation complexity ratings, and ROI projections to guide vendor selection

• The detailed implementation roadmap - Month-by-month action plans, budget allocation guidelines, KPI tracking frameworks, and change management strategies to execute AI transformation without disrupting operations

Download: The Autonomous Enterprise - Complete AI Successor Blueprint →

This comprehensive 30-page guide provides the complete strategic framework for maximising exit value through systematic AI-driven succession planning.

Further reading on this topic:

Due diligence with AI, buyer view: EY.

What changes in exit planning with AI: REV Global.

Automation helping an M&A advisor scale deal flow: Raincatcher case study.

Examples of AI use across M&A: DealRoom.

Reducing owner dependency before you sell: BizBuySell.

Finance automation that improves valuation narratives: CFO University.

Risks and guardrails worth knowing: Cloud Security Alliance.

Adapt & Create,

Kamil